Ultime notizie e approfondimenti

Rapporti e pubblicazioni dei nostri esperti di settore

Guide utili a portata di mano

Esempi di buone pratiche di gestione del credito in vari settori e mercati

Storie di successo dei nostri clienti

Gli effetti economici saranno modesti per il momento, ma l'accordo dovrebbe stimolare le esportazioni e i legami...

Un'indagine che coinvolge il presidente della Fed Powell potrebbe indebolire la fiducia nella politica monetaria statunitense,...

Quando un'azienda statunitense presenta istanza di fallimento ai sensi del Chapter 11, gli effetti spesso si estendono ben...

Dai mercati energetici alle catene di approvvigionamento, le mosse assertive di Washington stanno ridefinendo...

Le nostre previsioni per il primo trimestre del 2026 per settore di mercato...

L'incertezza economica legata alle tariffe continua a pesare sull'attività edilizia commerciale

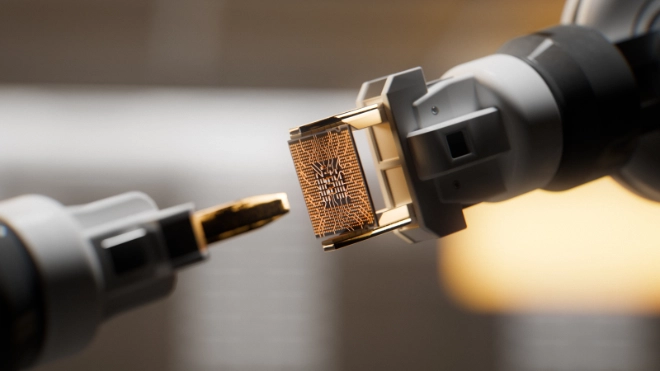

L'accelerazione della domanda di IA guida uno dei settori in più rapida crescita al mondo

L'Asia guida la crescita del settore farmaceutico, anche se le prospettive per tutte le regioni...

In un contesto globale frammentato, l'UE e l'India stanno perseguendo strategie diverse per rafforzare la resilienza economica e...

Scoprite come l'economia globale sta affrontando le tensioni commerciali e l'incertezza, con gli investimenti nell'intelligenza...

La crescita del settore rallenta mentre il commercio globale frena

Il partito GNU sudafricano riuscirà a superare le tensioni e le sfide strutturali per sbloccare...

Visualizzazione 7 fuori da 80

Comprendere cosa determina i costi dell'assicurazione del credito offre alle aziende preziose informazioni sui...

La longevità non è una questione di nostalgia. È una questione di resilienza, adattabilità e...

Strategie intelligenti per proteggere il flusso di cassa, rafforzare le relazioni con i...

Le aziende sono esposte al rischio di credito quando consegnano merci senza pagamento anticipato, ma nel caso di lavori...

L';assicurazione del credito è spesso fraintesa. I pregiudizi relativi al costo,...

Comprendere perché l'assicurazione del credito offre una copertura più ampia, una gestione strategica del rischio e...

Come gli assicuratori del credito valutano il rischio e determinano i limiti di credito appropriati

Visualizzazione 7 fuori da 36

Every customer is a...

Atradius Surety has enabled Vinci Construction France to expand their sources of finance beyond their banking...

With the backing of Atradius’s resources, EnCom Polymers has been able to expand business with existing customers and go...

BVV GmbH grew internationally and recognised risks such as companies on the brink of insolvency in plenty of time to mitigate the...

Visualizzazione 7 fuori da 11

Omron has achieved sustainable growth while navigating the uncertainties of China-US trade relations and regional manufacturing transformation.

FERM (International) offers competitive payment terms and limits their credit risk to developing countries by using Atradius Dutch State Business (DSB) and...

El Ganso credits our support in helping the fashion brand grow from a domestic-focused Spanish startup to a successful international business.

By providing open dialogue, insight and valuable credit information we helped Brook Green Supply improve their internal credit...

Late payers prompted content marketing agency KMOdynamoo to take out an Atradius credit insurance policy and has resulted in better debtor management.

Our agility and local knowledge of worldwide markets and buyers are key reasons why textiles business Georg Jensen Damask say they collaborate...

Janson Bridging (International) uses export credit insurance from Atradius Dutch State Business (DSB) to offer favourable credit terms to customers...

Visualizzazione 7 fuori da 10