Pressure on cash flow and profits amid surge in bad debts

There is a fragmented B2B payment landscape for companies across the United Arab Emirates (UAE), with steady conditions for some but others face increasing financial pressure

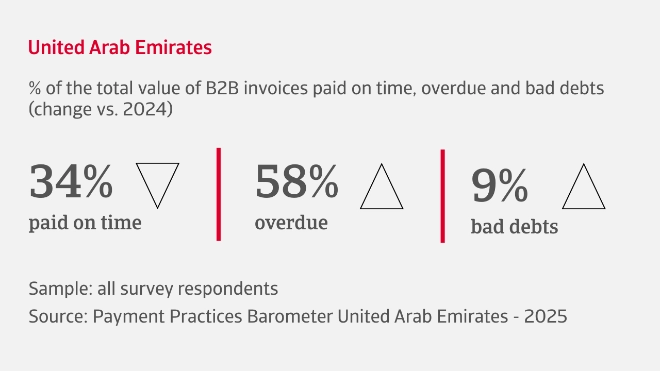

43% of businesses report no recent change in how B2B customers pay, while the rest are almost evenly split between those seeing quicker payments and those facing delays. Overdue invoices currently affect 58% of B2B sales, with delays largely driven by administrative inefficiencies in customer payment processes, a factor that can create cash flow strain even in the absence of deeper financial distress.

An even more significant concern is a rise in bad debts, which reveals that companies in the United Arab Emirates may need to strengthen debt collection practices to protect cash flow and reduce write-offs. Some companies are restricting trade credit offerings, some maintain stable terms, and the rest are expanded their offerings to remain competitive. In response to pressures on working capital, nearly half of the businesses are intensifying payment collection efforts. Days Sales Outstanding (DSO) is thus stable or improved for many, pointing to more effective working capital strategies.

What are the concerns for businesses in the United Arab Emirates in the coming months?

Sales optimism tempered by concerns over geopolitical instability

Our survey finds that companies across the United Arab Emirates are entering the second half of the year with cautious optimism but also keeping a keen eye on emerging risks. Firms are evenly divided in their expectations about the outlook for B2B customer insolvencies, with 50% foreseeing a rise and the rest anticipating no change during the months ahead. This uncertainty reflects the broader challenges faced by the UAE's trade-dependent economy amid continued global supply chain disruptions and geopolitical headwinds.

Looking ahead, most businesses recognise the critical importance of adaptability. There is widespread concern about intensifying geopolitical developments, shifting trade patterns, tightening regulatory demands, and growing environmental expectations. These challenges are prompting a greater focus on long-term sustainability strategies. These worries about an unpredictable economic climate leaves businesses in the United Arab Emirates facing a delicate balance. While strong sales and profitability outlooks suggest resilience, the mixed expectations on customer insolvency and working capital highlight financial vulnerabilities that could intensify if external pressures escalate. Adaptability, risk vigilance and efficient cash flow management will be key to maintaining stability in the months to come.

Amid confidence in the outlook for sales and profits, United Arab Emirates businesses remain concerned about rising global risks, making cash flow protection key to financial stability

Industry insights

Pharma

Around half of B2B sales in the pharma industry are currently conducted on credit, and as many companies have steady trade credit policies as those increasing their credit offerings. Three in five firms report no change in their payment terms, which currently average nearly 50 days from invoicing. Overdue payments impact about 60% of invoices, signalling persistent cash flow pressures. Delays typically extend beyond an additional month, with administrative holdups in customer payment processes the main cause. While bad debts remain capped at roughly 10%, companies are intensifying efforts to improve collections, helping to manage DSO and maintain cash flow predictability.

Steel and metals

60% of B2B sales in the steel and metals sector are transacted on credit, reflecting generally more lenient trade credit policies. While most companies have tightened payment terms, others report unchanged or slightly eased policies. Average terms stand at around 50 days from invoicing. Overdue invoices affect 55% of B2B transactions, underlining persistent liquidity pressures. B2B customer payment behaviour is fragmented, with many taking nearly two extra months to clear overdue bills. The most common cause is administrative inefficiencies. Bad debts are capped at around 5%. An intensified collection focus is helping many businesses to manage DSO volatility.

FMCG

Companies in the fast-moving consumer goods (FMCG) industry are adopting a more cautious stance on offering trade credit, with just over 50% of B2B sales now transacted on credit. While some firms continue with steady or more flexible terms, the broader trend leans toward greater credit discipline. Payment terms currently stand at around 40 days from invoicing. Late payments remain a significant concern, affecting 56% of B2B invoices. Most businesses report fragmented payment behaviour, with customers often taking up to an extra month to settle overdue accounts. Bad debts, ranging between 6% and 10%, continue to put pressure on working capital.

Interested in finding out more?

For a complete overview of the 2025 survey results for the United Arab Emirates, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

-

L'aumento dei crediti inesigibili registrato da molte aziende negli Emirati Arabi Uniti evidenzia la necessità di rafforzare le attività di recupero crediti per proteggere il flusso di cassa e ridurre al minimo le perdite.

-

Quasi la metà delle aziende sta intensificando gli sforzi di recupero crediti in risposta alla crescente pressione sul capitale circolante, con l'obiettivo di stabilizzare il flusso di cassa.

-

Le aziende degli Emirati Arabi Uniti sono divise sulle prospettive di insolvenza dei clienti B2B nella seconda metà dell'anno, con metà che prevede un aumento e l'altra metà che non prevede cambiamenti significativi rispetto ai livelli attuali.

-

Guardando al futuro, le aziende degli Emirati Arabi Uniti sono sempre più concentrate sull'adattabilità, poiché crescono le preoccupazioni per le tensioni geopolitiche, le pressioni normative e le esigenze ambientali