Growing liquidity pressure amid concern over level of bad debts

Most firms continuing with existing payment policies, highlighting a risk averse approach that preserves working capital stability in an uncertain payment environment

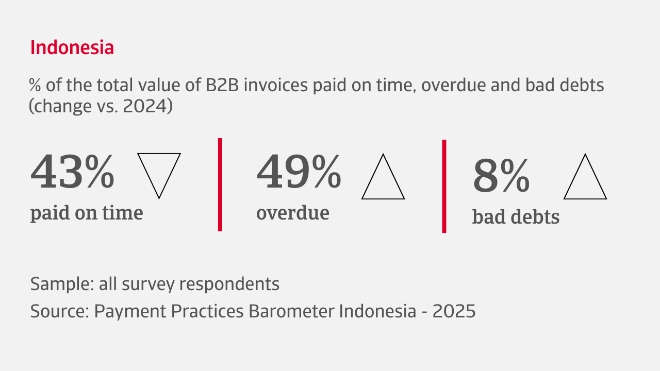

Nearly half of Indonesian companies report no significant change in B2B customer payment behaviour in recent months. However, an average 49% of B2B invoices are currently overdue, suggesting a substantial strain on cash flow and liquidity for businesses trading on credit. Payment delays are largely attributed to liquidity shortfalls and inefficiencies within the customer payment process. A significant 40% of firms have write-offs affecting up to 10% of invoices, culminating in an overall bad debts average of 8% of B2B invoices.

The result is a marked improvement in Days Sales Outstanding (DSO), helping companies to inject cash back into operations more quickly. Despite these improvements, liquidity is being locked up elsewhere. Many businesses report inventory build-ups, either due to cautious overstocking or sluggish demand, further restricting working capital. Some companies are now also being urged by suppliers to pay faster, highlighted by tightened Days Payables Outstanding (DPO) metrics. This points to systemic liquidity pressure in the broader supply network, not just among customers.

What are the concerns for Indonesian businesses in the coming months?

Uncertain economic landscape puts strain on working capital management

Our survey finds there is growing concern among Indonesian businesses about the outlook for customer payments related to B2B trade on credit as they look towards the latter half of the year and beyond. 50% of companies tell us they expect a rise in B2B customer insolvencies amid widespread anxiety about greater operational challenges and a more unpredictable market environment. The mood also reflects heightened worry about the ripple effects of US trade policy shifts, ongoing geopolitical tensions, and a slowdown in global growth.

One of the main concerns for companies in Indonesia as they plan for the months ahead surrounds the issue of rising production input costs, which are compressing profit margins and therefore becoming a risk to financial health. Another major worry is the growing burden of regulatory compliance, which is forcing businesses to revisit cost structures. Together, these factors signal a business landscape in which financial vulnerability is becoming more pronounced as the year unfolds.

Increased worries among Indonesian businesses about a negative outlook for B2B customer payments can lead to cash flow issues, making it challenges for businesses to maintain liquidity in the months to come

Industry insights

Agri-food

A broad expansion of trade credit offerings in the agri-food sector is reflected in 47% of B2B sales being transacted on credit, an increase on the previous year. Payment policies are mostly unchanged, with average payment terms averaging 50 days from invoicing. However, overdue invoices affect nearly half of all B2B transactions. Customers typically take more than a month to settle overdue payments, with delays largely attributed to internal inefficiencies and customer liquidity constraints. Almost 30% of agri-food companies report bad debt write-offs averaging up to 5% of B2B invoices, while others experience losses of 10% or more.

Pharma

66% of B2B sales are made on credit in the pharma industry, signalling a significant shift in trade credit policy as most companies extend more generous credit terms to customers. Payment policies are largely steady, with average payment terms now averaging around 50 days. Overdue payments affect an average 45% of B2B invoices. The primary cause for delays is customer liquidity constraints. A striking 75% of companies report bad debts ranging up to 10%, while the rest face even higher levels. In response, most businesses are intensifying collection efforts, reflected in notably shorter DSO. Inventory turnover and supplier payments are also mostly steady.

Packaging

A growing tendency to extend more trade credit to B2B customers means 49% of all B2B sales in the packaging industry are now transacted on credit. Payment terms remain unchanged for 50% of companies, a policy to partially offset this increased exposure to customer payment risk. The other half, however, are extending longer invoice settlement periods. Average payment terms currently stand at 55 days. Overdue invoices impact 53% of credit sales, with invoice disputes the chief reason for delays. More than half of companies in the sector report bad debts exceeding 10%, signalling considerable strain on cash flow.

Interested in finding out more?

For a complete overview of the 2025 survey results for Indonesia, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

-

Quasi la metà delle fatture B2B emesse dalle aziende indonesiane sono scadute, causando notevoli problemi di flusso di cassa e liquidità. I ritardi nei pagamenti sono dovuti principalmente a carenze di liquidità e inefficienze nel processo di pagamento.

-

Per gestire le pressioni sul flusso di cassa, la maggior parte delle aziende indonesiane è cauta nell'espandere il credito commerciale B2B e mantiene le politiche di pagamento esistenti per preservare la stabilità del capitale circolante.

-

A causa delle sfide operative in un contesto geopolitico ed economico imprevedibile, la maggior parte delle aziende indonesiane prevede un aumento delle insolvenze dei clienti B2B nella seconda metà dell'anno e oltre.

-

Le aziende di tutti i settori del mercato indonesiano prevedono che le fluttuazioni dei costi di produzione e gli oneri di conformità normativa comprimeranno i margini di profitto e aumenteranno la vulnerabilità finanziaria nei mesi a venire.