Surge in bad debts creates significant threat to cash flow

A negative trend in B2B payment behaviour is affecting liquidity and putting increased financial pressure on companies in Hong Kong

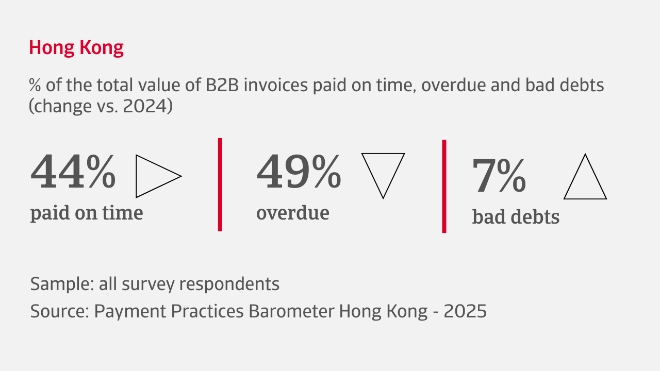

Our survey reveals that while 45% of businesses report no significant changes in how promptly customers pay, a larger share of the rest report a slowdown in customer payments rather than improvement. Overdue invoices now affect 49% of B2B sales on credit, with delays mainly attributed to customer liquidity constraints. Bad debts have surged, currently impacting 7% of B2B invoices, posing a serious threat to cash flow.

Despite these concerns, most companies are either maintaining or relaxing their trade credit policies to support customer relationships and sales volumes, even at the cost of increased financial exposure. Nearly 60% of B2B sales are now transacted on credit, with average payment terms around 60 days, leaving businesses exposed for longer durations. Days Sales Outstanding (DSO) is stable for most companies, but deteriorating collection trends outweigh improvements among the remainder.

What are the concerns for Hong Kong businesses in the coming months?

Widespread concern about rising insolvencies and customer payment risk

57% of companies tell us they anticipate a rise in B2B customer insolvencies during the months ahead, a significant increase from the same period last year. This shift highlights deepening anxiety about the territory’s economic prospects, particularly given Hong Kong’s heavy reliance on international trade. At the heart of these concerns is the uncertain trajectory of US–China relations, which leaves businesses exposed to external pressures, compounded by weak domestic demand and growing unpredictability around US trade policy.

Looking ahead to the second half of the year and beyond, companies across all sectors in Hong Kong widely recognise the importance of staying agile and responsive. Increasing regulatory demands and environmental pressures are expected to shape business strategies, prompting a stronger focus on sustainability practices. Altogether, these trends point to a growing exposure of the companies in Hong Kong that to customer payment risk, resulting in greater emphasis placed by businesses on effective risk management and strategic liquidity planning.

Amid geopolitical and economic uncertainty, most Hong Kong businesses expect tightening operational cash flow in the coming months

Industry insights

Consumer durables

44% of B2B transactions in the consumer durables sector are conducted on credit, reflecting mixed trade credit policies. Some companies have become more flexible with their credit terms, while others remain consistent or selective. This divergence is also visible in payment terms, which now average around 60 days from invoicing. Currently, 38% of B2B invoices are overdue, a figure that has improved in recent months. On average, customers take an additional month to settle payments past due, largely because of liquidity constraints. Bad debts have risen to 9%, a troubling development that poses a direct threat to margins and overall financial stability.

Electronics and ICT

Credit-based transactions are the norm in the electronics and ICT industry, with 65% of B2B sales conducted on deferred payment terms. Most firms have kept payment terms stable, currently averaging around 30 days from invoicing. 57% of invoices are now overdue, with B2B customers typically taking an additional month to settle past-due accounts. The main reasons for late payments include customer liquidity constraints and administrative delays in the payment process. Although bad debts remain at an average 4%, one-third of firms report a worsening in collections, limiting ability to swiftly convert receivables into working capital.

Textile and clothing industry

This sector is adopting a more risk-aware approach to B2B transactions in a bid to protect working capital and remain resilient amid economic uncertainty. 63% of B2B sales are transacted on credit, a decline from last year. While many companies maintain consistent payment terms, some offer more lenient arrangements to key customers, with current terms averaging around 44 days from invoicing. Overdue payments affect 52% of B2B invoices, an improvement from last year, with delays mainly caused by customer liquidity challenges. Bad debts have surged significantly to 7% of B2B invoices, placing further strain on working capital.

Interested in finding out more?

For a complete overview of the 2025 survey results for Hong Kong, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

-

Una tendenza negativa nel comportamento di pagamento B2B sta esercitando una pressione crescente sulla liquidità delle aziende di Hong Kong.

-

Le fatture scadute incidono ora sul 49% delle vendite B2B a credito, con ritardi attribuibili principalmente a problemi di liquidità dei clienti.

-

Tre aziende su cinque prevedono un aumento dei casi di insolvenza dei clienti B2B nei prossimi mesi, con un aumento significativo rispetto allo stesso periodo dell'anno scorso.

-

Si prevede che l'aumento dei requisiti normativi e delle pressioni ambientali influenzerà le strategie aziendali nei prossimi mesi