Concern about cash flow and profits in fragmented payment risk landscape

B2B payment risk varies across Asia, with businesses evenly split between stable, improved, and deteriorating customer payment behaviour

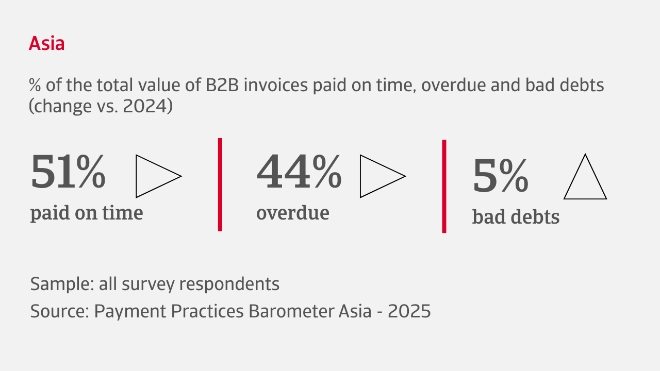

Overdue invoices currently affect an average 44% of all B2B credit sales across the region, highlighting a degree of strain on corporate cash flows. The key drivers of these delays are customer liquidity challenges and inefficiencies in internal payment processes. Bad debts average around 5% of B2B invoices, a seemingly contained figure, yet one that can have a significant impact on profitability.

Working capital management trends are mixed. Most companies across the region report either no change or an improvement in payment collection timelines, reflected in stable or decreasing Days Sales Outstanding (DSO). Inventory trends are evenly split between steady turnover and stock build-ups, the latter indicating liquidity being locked in unsold goods, potentially straining cash flow and limiting operational flexibility. The majority of firms say there is no change in the timing of payments to suppliers. However, among those who altered their approach, delayed payments outnumber faster ones, suggesting an effort to manage liquidity pressures by slowing cash outflows.

What are the concerns for Asian businesses in the coming months?

Rising anxiety about insolvency risk amid global trade policy uncertainty

A striking 50% of businesses across Asia tell us they anticipate an increase in B2B customer insolvencies during the months ahead. This concern reflects growing unease as elevated global trade policy uncertainties continue to ripple through domestic economies. The remaining half expect the current situation to remain stable, illustrating a region marked by a combination of cautious optimism and underlying fragility as companies look toward the second half of the year and beyond.

Looking ahead, half of Asia’s corporate sector acknowledges the critical importance of being responsive and adaptable to volatile economic and market shifts. Increasing regulatory compliance demands and heightened environmental concerns are driving companies to adopt more sustainable practices, which presents new operational challenges. Taken together, these features point to a corporate landscape that, while resilient, faces potential financial vulnerabilities. The balance of maintaining liquidity and managing risk in an uncertain environment will be pivotal for businesses navigating the months ahead.

Asian businesses recognise that staying agile in shifting markets is crucial to long-term financial health in an unpredictable world

Interested in finding out more?

The Atradius Payment Practices Barometer is conducted annually across markets worldwide to track B2B payment practices trends. The survey results for Asia was conducted during the second half of Q2 2025, covering China, Hong Kong, India, Indonesia, Japan, Singapore, Taiwan and Vietnam. Individual country reports will be published as part of the 2025 Payment Practices Barometer series, offering market-specific insights and sector analyses.

For a complete overview of the 2025 survey results for Asia, download the full report from the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

-

Le fatture scadute incidono sul 44% delle vendite a credito B2B in tutta l'Asia, principalmente a causa di problemi di liquidità dei clienti, con un tasso medio di crediti inesigibili pari al 5%.

-

Tre aziende asiatiche su cinque hanno ampliato l'offerta di credito commerciale nel commercio B2B, mantenendo invariati i termini di pagamento per contenere l'esposizione ai rischi di pagamento incostanti dei clienti.

-

La metà delle aziende asiatiche prevede un aumento dei casi di insolvenza dei clienti B2B oltre la metà del 2025.

-

I risultati del sondaggio indicano un panorama aziendale che, pur mostrando resilienza, rimane esposto a potenziali vulnerabilità finanziarie nei prossimi mesi.