Why is B2B customer financial resilience a concern for companies in Spain?

Market volatility increases concerns about shifts in B2B customer financial resilience and payment disruption

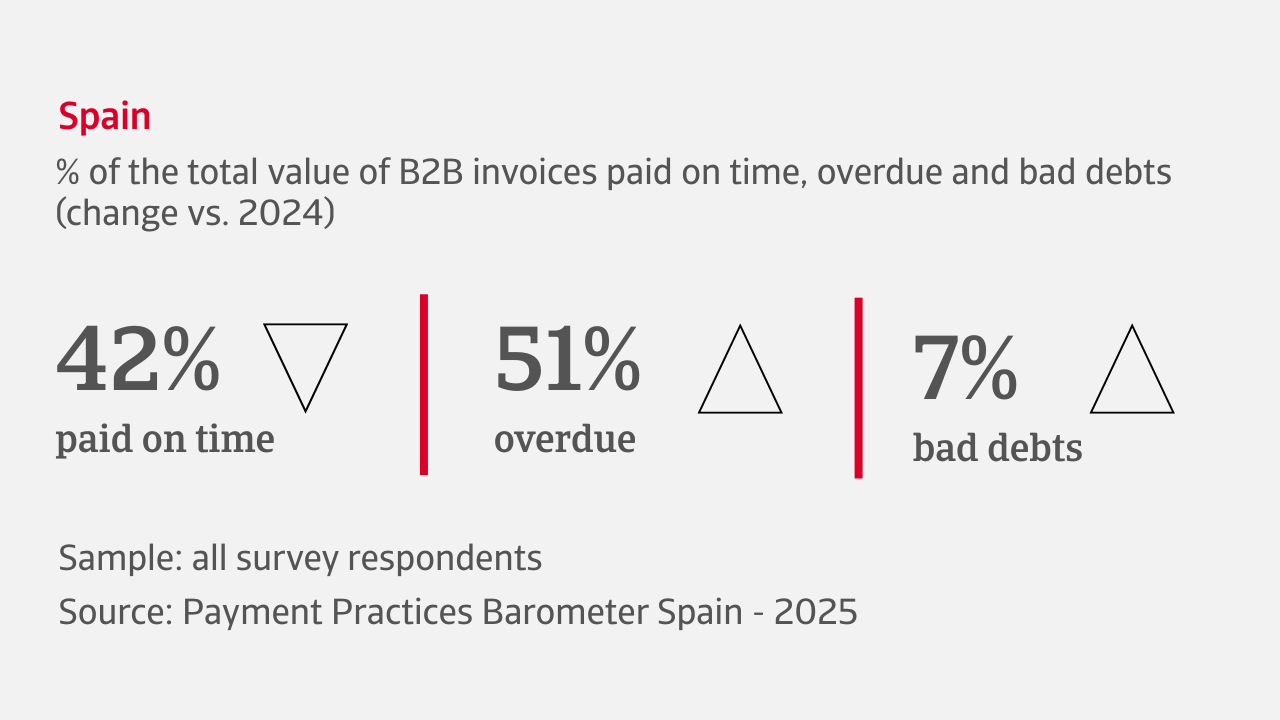

Widespread concern about business-to-business (B2B) payment practices is evident in our survey, with 63% of Spanish companies telling us they see no improvement in B2B customer payment patterns compared to last year. Overdue invoices currently affect an average of 51% of all B2B sales on credit, with late payments mainly due to cash flow issues during the current uncertain economic and trade landscape. Bad debts affect an average of 7% of B2B invoices, causing particular concern in the steel/metals sector.

.2025-09-25-13-03-09.png)

To promote strong customer relationships and stay competitive amid ongoing market volatility, many businesses adjusted their trade credit policies. 54% of companies increased credit offerings, and around two thirds of B2B sales are now being made on credit. Payment terms remain largely unchanged, ranging between 31 and 60 days from invoicing. This allows businesses to continue offering flexibility to customers while managing cash flow and limiting credit risk exposure.

What are the concerns for Spanish businesses in the coming months?

Spanish companies brace for rising B2B insolvencies payment disruptions and increased financial vulnerabilities

There is growing pessimism among companies in Spain about the outlook for B2B customer payment behaviour amid anticipated disruptions in global trade, mainly driven by US trade policies. The majority of businesses in our survey are preparing for continued delays and lingering uncertainty about worsening payment timelines. A similar shift of mood is also evident over insolvency risk, with around 50% of companies expecting a surge in B2B customer insolvencies during the coming 12 months. This is fuelling growing concern about financial vulnerabilities,

particularly among Spanish steel and metals companies.

Over 80% of Spanish companies across all industries now expect suppliers to demand quicker payments to maintain their own cash flow. The risk is that this will increase pressure on businesses which are already facing liquidity constraints and limited cash release from receivables or stock. Such financial strain will only make it harder for businesses to manage operational costs and bridge liquidity gaps.

In the coming months, businesses in Spain are most focused on three key challenges: the growing pressure of regulations and compliance, the impact of volatile production input costs on operations, and staying ahead of technological advancements

Industry insights

Agri-food industry

B2B sales made on credit in the agri-food sector slightly declined compared to last year, yet still account for nearly two-thirds ofthe industry’s B2B trade. To mitigate exposure to customer credit risk, three in five companies report keeping payment terms unchanged. Climate uncertainty and geopolitical tensions remain significant risk factors. They contributed to a negative trend in late payments, now affecting 42% of B2B invoices, and an increase in bad debts to 6% of B2B trade. Ramped-up payment collection efforts allowed Days Sales Outstanding (DSO) to remain unchanged amid an increased focus on cash flow management to maintain liquidity.

Key industry figures and charts are provided in the report available for download below on this page.

Construction industry

Trading on credit continues to play a vital role in the Spanish construction sector, with 63% of B2B sales made on credit. The trend showed little change from last year, although more companies have increased payment flexibility for customers. Late payments have worsened, now affecting 45% of the industry’s B2B invoices, mainly due to customer cash flow issues, but bad debts remained stable at 6% of B2B invoices. While companies stepped up collection efforts, and most kept DSO steady, many businesses are not seeing much relief from cash flow pressures. Consistent stock levels have helped reduce supply chain disruptions, but this also implies that companies are not freeing up much liquidity from inventory.

Key industry figures and charts are provided in the report available for download below on this page.

Steel and metals industry

Our survey found that 60% of B2B sales are made on credit in the steel/metals sector, with many businesses showing an increase due to strong demand from the construction, automotive, and manufacturing industries. To balance this approach, 71% of companies kept payment terms steady, reflecting a desire to support strong customer demand while protecting financial health. Various risk factors, including economic fluctuations, supply chain disruptions and higher production costs, had a negative impact on B2B payment behaviour. Late payments currently affect more than two-thirds of B2B invoices, while bad debts stand at an average of 6% to 10% of B2B invoices.

Key industry figures and charts are provided in the report available for download below on this page.

Interested in finding out more?

For a complete overview of the 2025 survey results for Spain, download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- La maggior parte delle aziende spagnole non registra miglioramenti nei modelli di pagamento dei clienti B2B rispetto all'anno scorso, indicando la continua instabilità finanziaria dei clienti.

- L'impatto delle fatture scadute sul commercio B2B, dovuto principalmente al flusso di cassa, evidenzia l'attuale fragilità della salute finanziaria dei clienti.

- La metà delle aziende spagnole si sta preparando ad affrontare l'aumento delle insolvenze nei pagamenti B2B e l'aumento delle vulnerabilità finanziarie.

- Proteggere la salute finanziaria a lungo termine è diventata una priorità fondamentale per le aziende spagnole, a fronte di molteplici fattori di rischio che si prevede avranno un impatto sull'attività nei prossimi mesi.