B2B customer payment risks remain major challenge for CEE companies

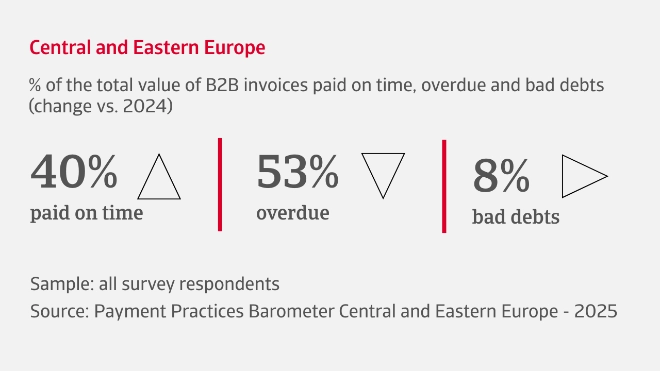

Our survey finds clear signs of a worsening trend of B2B customer payment behaviour across Central and Eastern Europe (CEE). More companies report a deterioration in late payments than improvement. Overdue invoices remain a pressing issue, accounting for an average of 53% of all B2B sales on credit in the region. Bad debts stand at an average 8% of all B2B invoices, with the Czech Republic reporting the most severe impact.

Many businesses across the CEE region are struggling to unlock liquidity from working capital. Days Sales Outstanding (DSO) is mostly unchanged, while inventory levels have either stagnated or increased for a significant number of companies, with stock build-ups further limiting access to liquid funds. These trends point to a constrained cash flow environment, where capital is increasingly trapped in unpaid invoices or unsold goods. To preserve liquidity, most companies have kept Days Payable Outstanding (DPO) steady. Bank loans, supplier credit and invoice financing are the main methods for bridging cash flow gaps among CEE companies.

What are the concerns for Central and Eastern European businesses in the coming months?

Rising liquidity concerns hit CEE firms amid looming economic uncertainty

An increase in B2B customer insolvencies is expected by 54% of companies across the CEE region during the coming months, with many others expressing uncertainty about future insolvency risks. This highlights rising fears around payment defaults and reveals that businesses are bracing for mounting financial pressure ahead. Caution is also found over payment collections, with companies evenly divided between those expecting no significant acceleration and others anticipating slower collections. Such sentiment underscores the challenges faced in maintaining steady cash flows.

Businesses in Central and Eastern Europe are concerned about adapting to economic shifts, managing regulatory compliance, and adopting sustainable practices

Looking ahead, companies across CEE express growing concern over their ability to adapt to a rapidly evolving and unpredictable business environment. The combination of unexpected economic shifts, tightening regulations, and mounting environmental pressures is placing additional strain on corporate stability. Rising production input costs are expected to further squeeze profit margins, while the growing need to integrate sustainable practices adds to operational complexity, especially for smaller firms with limited financial flexibility. These concerns reflect widespread anxiety that growing pressure on working capital may lead to increased financial vulnerability in the coming months.

Interested in finding out more?

The Atradius Payment Practices Barometer is conducted annually across markets worldwide to track B2B payment practices trends. The 2025 Central and Eastern Europe (CEE) survey was conducted between the end of Q1 and mid- Q2 2025, covering Bulgaria, Czech Republic, Hungary, Poland, Romania, Slovakia, Slovenia and Türkiye. Individual country reports will be published as part of the 2025 Payment Practices Barometer series, offering market-specific insights and sector analyses.

For a complete overview of the 2025 survey results for Central and Eastern Europe download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- Overdue invoices make up 53% of the sales that companies in Central and Eastern Europe (CEE) make on credit in B2B trade

- Businesses across the CEE region are struggling to unlock working capital trapped in receivables and stock

- Over half of businesses in CEE expect B2B customer insolvencies to surge in the coming months

- The unpredictable economic and trading landscape is leading to strong concerns about financial vulnerability of business customers across industries in the region