President Trump’s highly unpredictable trade policies pose significant risk to global trade and the economy. “Liberation Day” - 2 April - saw the US impose substantial 'reciprocal tariffs' on its trading partners, only to grant exceptions for products like copper, pharmaceuticals, smartphones and computers shortly afterwards. Reciprocal trade tariffs were later

suspended on all trading partners for a period of 90 days, though more recently the US administration has doubled tariffs on steel and aluminium to 50%.

A separate deal was made with China that also temporarily reduced the tariffs between the two countries, though both have since accused the other of breaking the terms of the deal. Nevertheless, a recent meeting in London ended with the two economic superpowers agreeing in principle to a framework for de-escalating trade tensions.

Today, as the dust settles a little, the effective US tariff rate stands around 15%, up from 2.4% at the end of 2024 and the highest level since the Great Depression. What happens next is anyone’s guess, but that uncertainty is weighing heavily on business.

With that in mind, we estimate that global growth will decrease to 2.4% in 2025 and 2026, a 0.6 percentage point (ppt) drop compared to our March 2025 forecast and a 0.9ppt decline from our pre-tariff January 2025 prediction.

Where we are today

Economic forecasting is always a hostage to fortune, and never more so than now. In the early days of President Trump’s second term, ‘definitely’ can become ‘maybe’ in the blink of an eye.

But whatever happens from now on, much damage has already been done. “We expect the impact on global GDP growth, inflation and trade to be significant,” says Dana Bodnar, economist at Atradius. “Tariffs push GDP growth down through lower demand and push inflation up through higher prices. Importing firms face higher costs, either reducing profit margins or increasing consumer prices.”

Tariffs on China remain at 30%, with China’s retaliatory tariffs on US goods at 10%,

In addition, the universal 10% tariff remains in place, alongside 25% tariffs on cars, 50% on steel and aluminium and 25% tariffs on goods from Mexico and Canada that are not USMCA (United States Mexico Canada Agreement) compliant.

“Going forward, we expect an effective US tariff rate of about 15% to remain,” adds Bodnar. “Even if the next policy steps are uncertain, it generally takes much longer to reduce tariffs than implement them.”

The US - a self-inflicted economic wound

Regardless of details, the world faces an aggressively protectionist US and retaliatory measures by outraged trading partners, at least in the short term. The result is likely to be a reduction in growth, widespread price increases and profound changes in supply chains and trade flows.

In economic terms, the US will suffer a deep self-inflicted wound. We now expect the US economy to grow by just 1.5% this year and 1.9% in 2026, cumulatively 1.9% lower than our expectations at the beginning of the year.

Tariffs have not bitten yet. Our revision is almost fully driven by a much weaker outlook for business spending as firms postpone investments. The consumer outlook, though resilient, is also downbeat. Tariffs on US imports will directly contribute to higher inflation and rising prices will erode real disposable incomes.

“Consumer sentiment is down about 15 points since the start of the year,” says Bodnar. “This is in part due to consumer expectations of inflation ticking up, alongside likely higher-for-longer interest rates and some labour market softening.”

Canada and Mexico - first in the firing line

Among US trading partners, the United States’ immediate neighbours perhaps have most to lose. Canada and Mexico are heavily exposed to US trade policy, with markets that are strongly integrated with the US economy.

In our forecast, Canada’s 2025 economic outlook is down 0.6ppt to just 0.9%. Mexico’s downward revision of 1.7ppt to zero GDP growth amounts to effective stagnation, driven by lower investment and investor sentiment and long-standing concerns over institutional quality.

The eurozone is also hit hard. According to President Trump, the EU was formed “in order to screw the United States.” His tariffs will further weaken the bloc’s anaemic growth prospects, with eurozone GDP expected at just 0.9% annually in 2025 and in 2026. That’s 0.6ppt below our January 2025 forecast. US tariffs will be a drag on European trade and investment, prolonging the industrial downturn in Europe.

China loses some steam

Our forecast for China is less pessimistic, with growth down 0.2ppt to 4.3% in 2025, despite 30% US tariffs. “Stimulus measures, front-loaded export orders and relatively good weather conditions have made the slowdown slightly more gradual than previously expected,” says Bodnar.

Still, China's economy is losing steam. Surging exports will slow as US tariffs come into effect, alongside declining investment in domestic manufacturing.

Sectors under stress

Eventually, many businesses will feel the impact of a tariff war as economies flatline, investment falls and consumers tighten their belts.

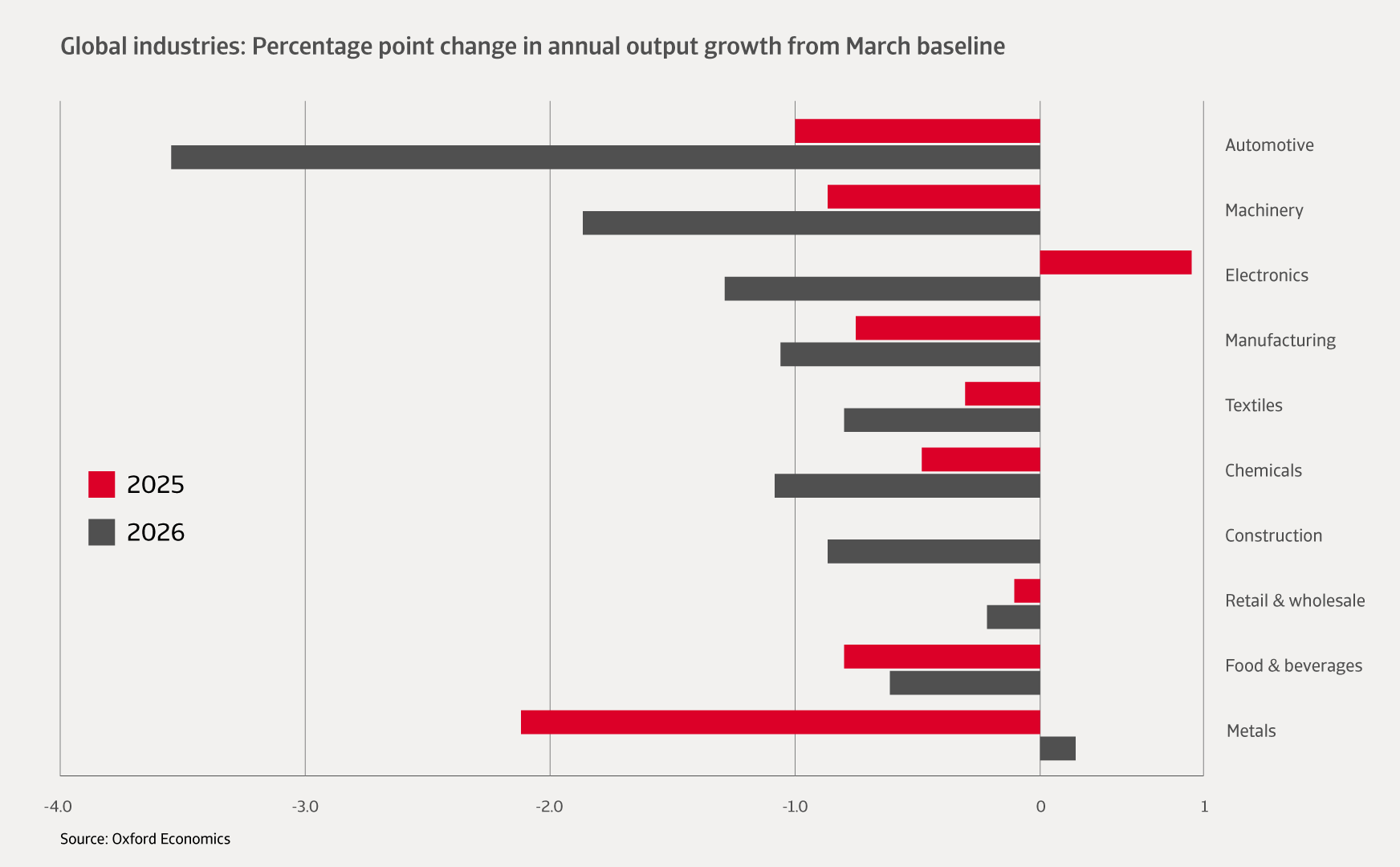

But global trade and manufacturing will be hit earliest and hit hardest. If tariffs remain roughly as they are now through 2025 and 2026, we expect global manufacturing production growth to decrease by 0.7%ppt in 2025 and by 1.1% in 2026.

The 90-day suspension of reciprocal tariffs and the de-escalation in US-China trade tensions are a step in the right direction, but the outlook for industrial activity remains well below our expectations in March, prior to "Liberation Day". Firms have frontloaded activity in Q1 in an attempt to shield themselves from future tariffs, prompting our forecast of industrial recession in the second and third quarters of this year.

Uncertainty will dampen business and household sentiment, and reduce firms' willingness to invest. This will disproportionately affect activity in investment-driven industries like

construction and capital goods.

As countries export less to the US they lose income and import less from elsewhere. In a vicious circle of decline, business investment will stagnate as uncertainty undermines long-term planning. Inevitably, sectoral impacts will be more pronounced than macroeconomic ones in the most affected industries.

“Companies from countries heavily reliant on exports to the US or from sectors targeted by specific tariffs may face decreased trade volumes, significantly increased costs and reduced profitability, leading to increased credit risk,” says Bodnar.

Sectors with long international supply chains will be most vulnerable, along with those highly dependent on investment to drive demand. Automotive and machinery are two of the most exposed sectors. We take a deeper dive into their prospects in the next section.

Carmakers brace for impact

President Trump's former confidant Elon Musk has reportedly made several personal appeals to the President to reverse the new tariff regime. As Tesla CEO, he has skin in the game. The automotive sector is likely to be among the hardest hit by the new charges, which were recently raised to 50%

Compared to our March 2025 forecast, we now expect 4.6ppt lower output growth in 2025 and 2026 globally. US automotive production is predicted to be 10.1ppt lower, while vehicle and motor parts production in Canada (-9.8ppt), Mexico (-1.7ppt), Japan (-6.0ppt),South Korea (-9.3ppt) and Germany (-3.6ppt) will also suffer. North American automotive supply chains are highly integrated, with parts often crossing borders several times before assembly.

At the end of April the Trump administration moved to ease some levies, but the results are likely to be modest. Against this, global automotive supply chains will be disrupted, adding to cost pressures.

In the US, weaker consumer confidence will dent demand across the economy, but big-ticket items like cars are likely to be particularly affected. As a major steel consuming sector, automotive will feel the impact of recently imposed 50% steel tariffs more than most.

“Any disruption from tariffs will increase production costs for US automakers, reduce supply chain efficiency, and ultimately impact long-term sector competitiveness,” says Alex Geach, senior underwriter at Atradius. “While higher production costs will likely be passed on to consumers, this will lead to higher credit risk in the industry, in particular in the supplier subsector.”

Machinery and engineering feel the heat

Machinery and engineering will suffer along with their struggling target markets. Across manufacturing sectors, investment that would usually be made to modernise factory equipment will be cancelled or delayed. The result is expected to be a global fall in output of 2.7ppt compared to our March forecast. That includes a 9.4ppt drop in the US, and declines in other key producer nations including China (-1.6ppt), Japan (-4.3ppt) and Germany (-1.4ppt).

If Germany appears to come off rather lightly in this forecast, it is only because the German machinery and engineering sector was already in steep decline. The industry continues to struggle in the face of weak demand from key domestic and foreign buyers and increasing Chinese competition.

“Non-payments and insolvencies in the German machinery industry increased by double-digit rates in 2024, and we expect business failures to rise again in 2025,” says Jens Stobbe, manager of Risk Services at Atradius. “While smaller companies with smaller financial cushions will be hit first, even larger businesses could fail.”

A Presidential change of heart?

Recent developments have dialled down tariff tensions a little. It’s not inconceivable that President Trump has blinked first in the trade war he provoked, spooked by a bond market backlash and negative consumer sentiment. But “Liberation Day 2” is not out of the question either, given the volatility of the President’s position on trade and his obvious mistrust of economic rivals.

Maybe the US and China will conclude a new trade deal. Maybe Trump will impose new tariffs on EU goods or the imports of specific industries. Legal challenges in the US to Trump’s tariff policy have added to the unpredictable environment. Uncertainty is already having a significant impact, as orders are cancelled and investment postponed around the world. A calm, of sorts, has settled, but the impacts of the Trump trade war are here to stay.

- Recent developments have dialled down tariff tensions a little, but the impact on global GDP growth, inflation and trade to be significant.

- Sectors with long international supply chains will be most vulnerable, along with those highly dependent on investment to drive demand.

- Automotive and machinery are two of the most exposed sectors, with major production decreases in 2025 and 2026 compared to our March forecast.