Good payment behaviour in the household appliances, furniture and consumer electronics segments over the past two years, and no major changes are expected.

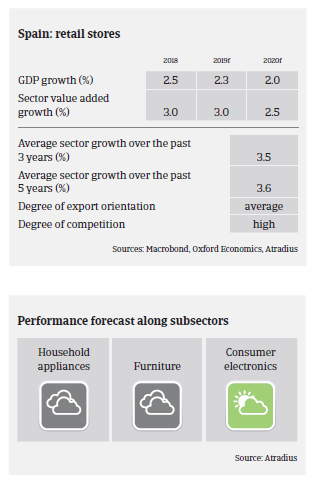

- Consumer durable goods are expected to continue their sales expansion in 2019, although at a lower pace than last year as private consumption growth is expected to slow down to 2.0%.

- Profit margins in the consumer durables retail industry generally remained stable in 2018, and this development is expected to continue in 2019. External indebtedness is not overly high in the industry, as businesses generally do not make large investments, while their financing needs are mainly tied to working capital.

- Competition in the Spanish consumer durables sector remains high and will increase further over the coming years. E-commerce businesses continue to expand their market share, with annual growth rates of more than 20%. Brick-and-mortar businesses have to adapt to the rapidly changing market conditions and consumer habits in order to defend their market position.

- On average, payment duration in the sector ranged from 60 to 90 days. Payment behaviour in all major subsectors (household appliances, furniture, consumer electronics) was relatively good over the past two years, and no major changes are expected as the general performance outlook remains positive. Consumer durables retail insolvencies increased slightly in 2018, mainly of small businesses with low total asset value. The number of business failures in the industry is expected to level off in 2019.

- Our underwriting approach remains positive for the consumer electronics segment while it is neutral for household appliances. In this segment e-commerce competition could have a significant impact on local and small retailers in the short-term. At the same time lower private consumption growth in 2019 and 2020 will impact sales growth.

- Despite growth over the last couple of years, our underwriting stance on furniture is neutral, as this subsector is closely linked to construction performance and large retailers put pressure on their smaller peers.

- Our underwriting stance is also neutral for the textile retail segment. In 2018, sector activity in Spain decreased 2.2%, mainly due to seasonal conditions (weather), but is expected to increase again in 2019. Textile retailers are facing the sharp growth of e-commerce and changing consumption priorities. Smaller, highly-leveraged businesses are the most vulnerable in this subsector.

Documenti collegati

1.05MB PDF