The pharmaceuticals sector performs very well in both countries. However, the French pharmacy segment faces some troubles due to decreasing margins.

European football championship 2016

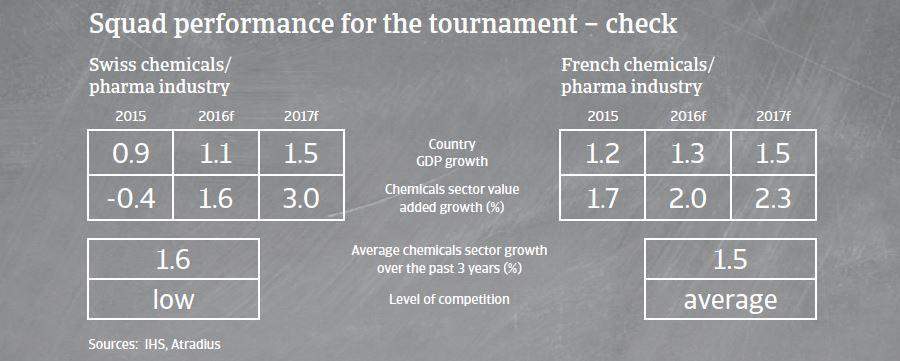

Sector playing field: pharmaceuticals industry

Switzerland: no real weak points

The performance of the Swiss pharmaceuticals industry has been strong for years, with most businesses showing good financial health. Gearing of businesses is generally low, while banks are very willing to provide loans.

Many Swiss companies in this sector benefit from a geographically well diversified customer portfolio, which ensures a good risk distribution of their trade receivables.

As many Swiss pharmaceuticals businesses have diversified their production sites outside Switzerland, they are among the Swiss export-driven sectors that are least affected by currency volatility / a high Swiss franc. Demand and profit margins in this industry are expected to remain stable in 2016.

Quite a number of larger Swiss pharmaceutical companies are stock-listed or can issue bonds.France: fragmented market, but performance remains robust

In France, consumption of pharmaceutical products is increasing in volumes. However since 2012 the market has shrunk in value due to pressure on selling prices following government measures to reduce social security deficits. Retail prices are regulated and decreased 1.1% in 2015. The growth in volumes is insufficient to offset this impact, while the French government keeps pushing for further drug price decreases.

Due to the promotion of the use of generic drugs the market share of this segment has increased. This, together with lower sales prices has negatively impacted profit margins in the industry. The French pharmaceutical market is shifting from a value-based one to a volume-based one. IMS Health estimates the compound annual growth rate of pharmaceuticals in the period 2016-2020 to be between -3% and 0%.

The French pharmaceuticals market is highly fragmented, as none of the large players has more than 10% market share. Given that retail prices are regulated, competition is not overly high for manufacturers. However, pharmaceuticals wholesalers must provide sales discounts to compete with each other as there is little differentiation possible, and there is a need to reach critical mass.

Players to watch

Switzerland

France

Both pharmaceuticals manufacturers and wholesalers benefit from the fact that the industry is highly regulated, which provides entry barriers, restricts competition, and allows acceptable profit margins. Despite decreasing prices imposed by the government the sector is supported by increasing volumes and most companies display healthy balance sheets with average leverage.

The pharmacy/drug store segment suffers from overcapacity and decreasing margins due to lower sales prices and the increasing use of generic drugs. In this segment late payment issues occur more frequently, on average, than in other subsectors.

Major strengths and weaknesses

Swiss pharmaceuticals industry: strengths

French pharmaceuticals industry: strengths

- Leading global position in R&D and high labour productivity

- Strong in the live science segment

- Large producers are selling world-wide and are geographically diversified

- Not overly affected by currency volatility

- Still satisfying profit margins

- Growing demand in volumes

- Price regulation prevents fierce competition

- Large domestic market

Swiss pharmaceuticals industry: weaknesses

French pharmaceuticals industry: weaknesses

- Highly dependent on global demand

- Domestically prices are under pressure due to a rising number of generics

- Decreasing retail prices imposed by the government

- Overcapacity of pharmacists

- High labour costs, regulation and juridical complexity encourage industrial groups to develop new products outside of France.

Fair play ranking: payment behaviour and insolvencies

Swiss pharmaceuticals industry

The average payment duration in the Swiss pharmaceuticals industry is 45 to 60 days.

Payment experience has been good over the past two years and protracted payments are low.

Non-payment notifications are low, and we do not expect increases in the coming months.

The level of pharmaceuticals insolvencies is low, and it is expected that there will be no change in the coming months.

French pharmaceuticals industry

Payment experience has been very good over the past two years and protracted payments are low.

Non-payment notifications are low, and we do not expect increases in the coming months.

The level of pharmaceuticals insolvencies is very low, even though the market is shrinking, profit margins are still acceptable and the sector is resilient. No insolvency increases are expected in 2016.