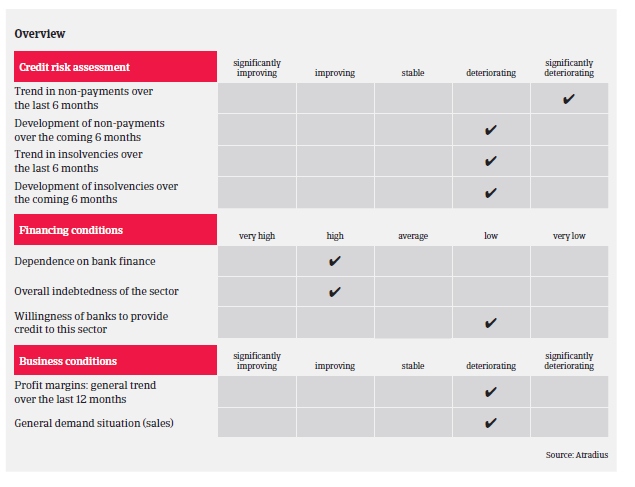

The payment duration in the industry has increased to 70 days on average, and the payment experience over the past two years has been rather bad.

- Increase in insolvencies expected in 2019

- Slowdown in the residential construction segment

- Smaller players still face financing issues

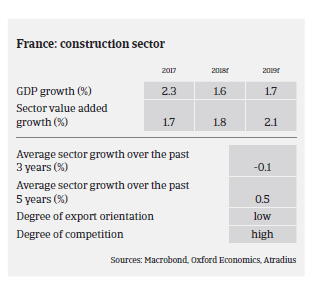

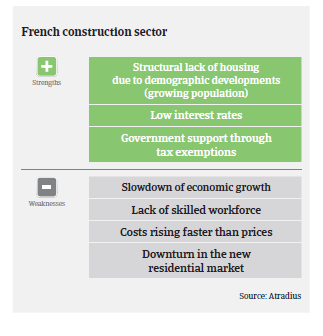

According to the French Builders Association FFB (Fédération Française du Bâtiment), the construction sector grew a robust 5% in 2017, mainly driven by a surge in the new residential building market (new housing starts reached 430,000 units, the highest in six years).

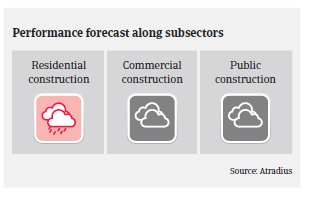

However, in 2018 production output slowed down to 2.3% as residential construction did not perform as well. Housing permits decreased 6.6% after a 7% increase in 2017, and another decline is anticipated in 2019 impacting both single-family and multi-family housing. New housing permits are forecast to decrease by about 8% and new housing starts to decline 5% in 2019.

The ongoing slowdown in residential construction is mainly due to a weaker economic environment and lower household purchasing power (impacted by rising real estate and energy prices, and an increase in the CSG social charge tax). At the same time, public spending for new housing decreased in 2018. The scope of beneficiaries to tax exemptions (for both first-time buyers and investors) has been significantly reduced, and investment in social housing has declined. Therefore residential construction output is expected to contract by about 0.5% in 2019.

Production in non-housing construction is expected to increase 3% in 2019 driven by ongoing dynamism in office building (mainly in the Paris area). However, this would be a marked slowdown compared to the 7% growth in 2018. Commercial construction still struggles with decreasing demand from the retail sector, which is partly due to growing competition from e-business.

While the production capacity utilization rate remains above its long-term average, the construction sector suffers from a lack of skilled work force. Among businesses with more than 10 employees, four out of five report difficulties in hiring the right employees. As a consequence, many businesses have to refuse new orders and are limited in expanding their business.

Profit margins decreased in 2018 and are expected to deteriorate further in 2019. While construction businesses face higher prices for commodities and energy as well as increased labour costs, they struggle to pass on those price increases due to fierce competition. Larger contractors keep putting pressure on their subcontractors.

In 2017 and 2018 the sector reported severe cash management issues as companies found it difficult to fund their increasing working capital requirements in the framework of the business recovery after several difficult years. Operating margins remained tight, whereas a significant amount of cash was needed to fund order books. At the same time, banks remain very selective with their loans to construction businesses, making access to short-term credit difficult. Cash management remains a major issue for many, mainly smaller, construction businesses.

Payments in the construction industry take 70 days on average. The payment experience over the past two years has been rather bad, and non-payment notifications increased significantly last year, especially in H2 of 2018, reflecting difficulties in the structural works, single-housing construction of individual housing and construction material wholesalers segments. Construction insolvencies decreased in H1 of 2018, but started to increase again in the second half of the year, mainly due to a deterioration in structural and secondary works. Business failures are expected to increase further in H1 of 2019, also affecting businesses with more than 10 employees.

In this context we have tightened our underwriting stance for the time being. However, we continue to provide cover to our customers whenever it is reasonable and prudent to do so.

We focus on the cash situation and loan facilities available to buyers, especially smaller and mid-sized companies. Several key financial indicators must be analysed: the level of activity, margins and ability to fund working capital requirements. High financial costs are a key indicator of potential pressure on cash. We also try to assess the ability of construction businesses to manage bigger projects than usual, as we often notice that smaller enterprises cannot cope with financial distress due to insufficient pricing and allocation of resources.

Documenti collegati

1.19MB PDF